It’s recommended a business with a high number of cash transactions reconcile more frequently to avoid mistakes. The entries in the statement stop being the cause of discrepancies after a few days. Bank reconciliation statements safeguard against fraud in recording banking transactions. The bank reconciliation statement explains the difference between the balance in the company’s records and the balance in the bank’s records. You need to determine the underlying reasons responsible for any mismatch between balance as per cash book and passbook before you record such changes in your books of accounts.

Ready to save time and money?

Infrequent reconciliations make it difficult to address problems with fraud or errors when they first arise, as the needed information may not be readily available. Also, when transactions aren’t recorded promptly and bank fees and charges are applied, it can cause mismatches in the company’s accounting records. Interest is automatically deposited into a bank account after a certain period of time. So the company’s accountant prepares an entry increasing the cash currently shown in the financial records. After adjustments are made, the book balance should equal the ending balance of the bank account. Before you reconcile your bank account, you’ll need to ensure that you’ve recorded all transactions from your business until the date of your bank statement.

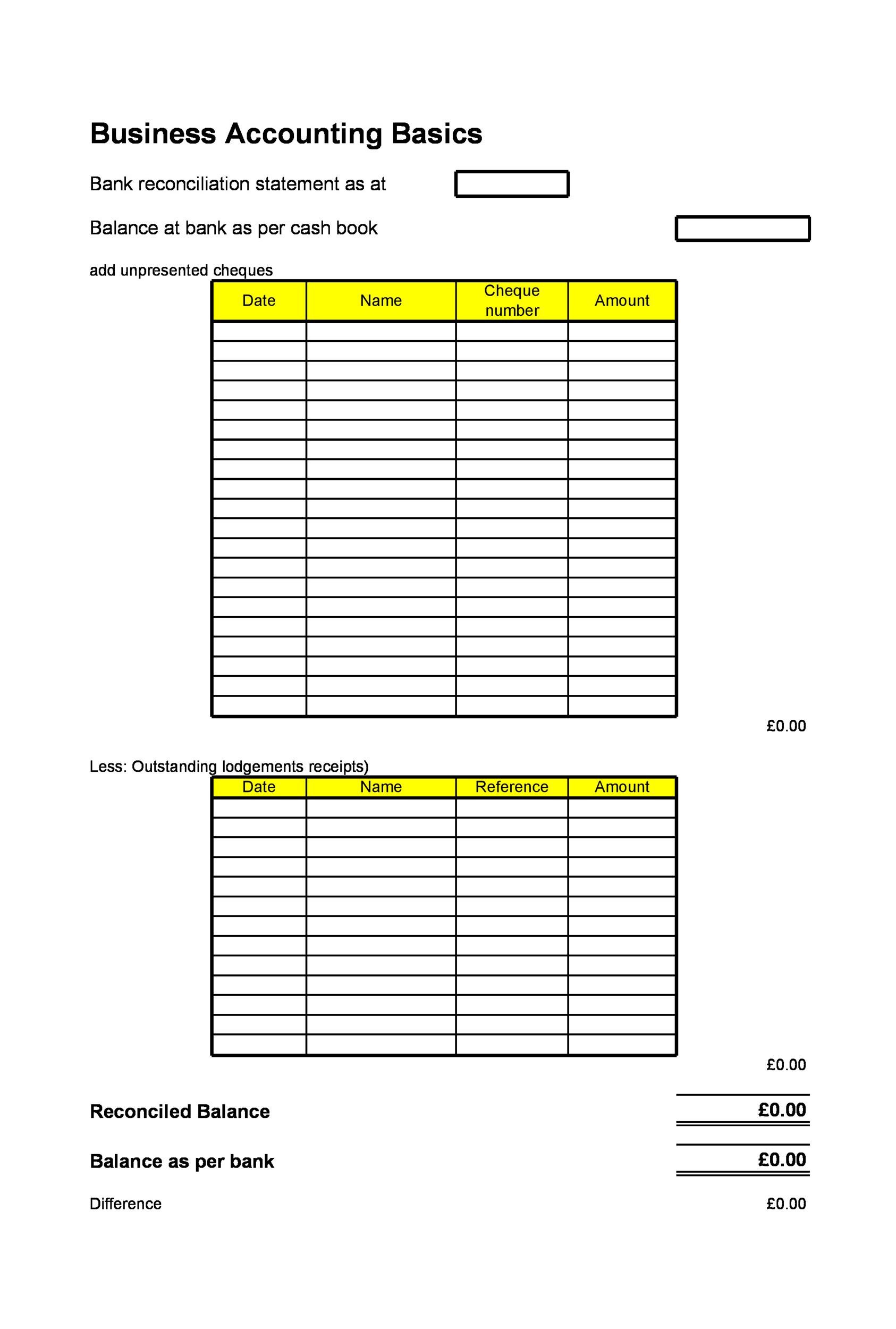

Write up the Cash Book

- See how forward-thinking finance teams are future-proofing their organizations through AP automation.

- He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- To create a bank reconciliation, you will need to gather your bank statements and reconcile them with your accounting records (ledger).

The reason could be that deposits are in transit or outstanding checks have not yet been reflected. Bank reconciliation is crucial for businesses to maintain financial accuracy, detect fraud, and manage cash flow effectively. Learn more about the benefits of finance automation here to explore how automation can streamline bank reconciliation and other AR processes. To quickly identify and address errors, reconciling bank statements should be done by companies or individuals at least monthly. They also can be done as frequently as statements are generated, such as daily or weekly. Deduct from the bank statement balance the proceeds of any check that you have issued and entered in your accounting record but have not been presented to paid by the bank.

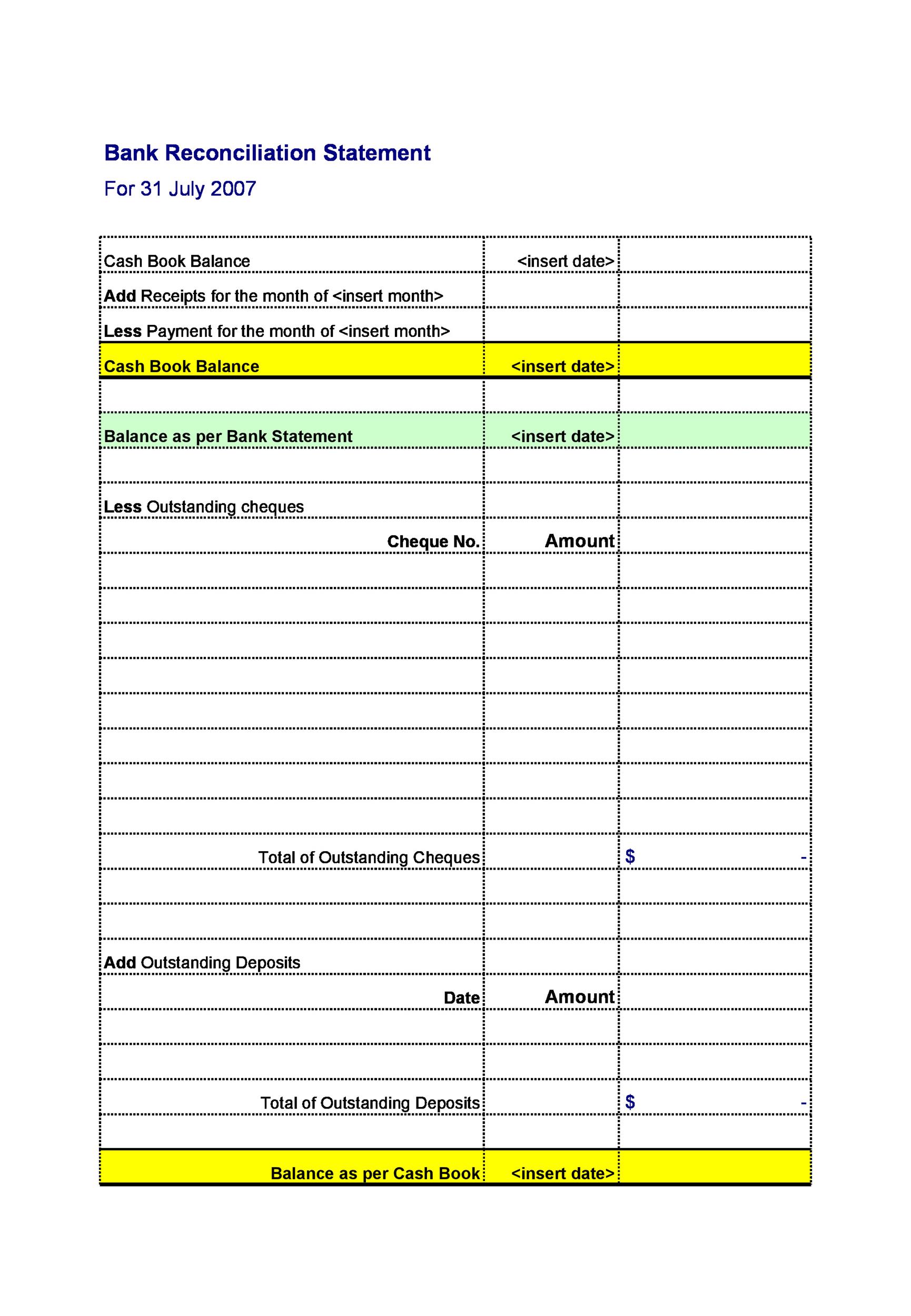

Example #3 of Bank Reconciliation Statement Template

When an account holder issues a cheque, which the bank pays, the bank debits the account holder’s personal account. The items in the bank section show that the bank’s version does not agree with the books capital gain because a deposit had not been processed and the checks had not yet been canceled. In the past, monthly reconciliations were the norm because banks used to issue paper statements on monthly basis.

Theoretically, the transactions listed on a business’ bank statement should be identical to those that appear in the accounting records of the business, with matching ending cash balances on any given day. After reviewing all deposits and withdrawals, adjusting the cash balance and accounting for interest and fees, your ledger’s ending balance should match the bank statement balance. If the two balances differ, you’ll need to look through everything to find any discrepancies. Check the balances of the bank statements and the cash balance in your books after you’ve adjusted all the transactions and compared them. If not, there may be checks outstanding or deposits in transit or you may need to perform another reconciliation.

Credit entries for interest earned:

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. (b) Checks Nos. 789 and 791 for $5,890 and $920, respectively, do not appear on the bank statement, meaning these had not been presented for payment to the bank by 31 May. (a) Deposits made by Sara Loren on 30 May, $1,810, and on 31 May, $2,220, have not been credited to the bank statement.

Deposit in transit means the cash received from a party has been recorded by the depositor but has not been entered by the bank in the bank statement. The need and importance of a bank reconciliation statement are due to several factors. First, bank reconciliation statements provide a mechanism of internal control over cash. After adjusting the balance as per the cash book, you’ll need record all adjustments in your company’s general ledger accounts. You’ll need to adjust the closing balance of your bank statement in order to showcase the correct amount of withdrawals or any checks issued that have not yet been presented for payment. Preparing a bank reconciliation statement is done by taking into account all transactions that have occurred up until the date preceding the day the bank reconciliation statement is prepared.

Likewise, ‘credit balance as per cash book’ is the same as ‘debit balance as per passbook’ means the withdrawals made by a company from a bank account exceed deposits made. Discrepancies in bank reconciliations can arise from data processing errors or delays and unclear fees at the bank. Unpredictable interest income may also be a challenge when calculating financial statements, which can lead to challenges during a bank reconciliation. Greg adds the $11,500 of deposits in transit to his bank statement balance, bringing him to $99,500. He also subtracts the $500 in bank fees from his financial statement balance, bringing him to $99,500 and balancing the two accounts.

A bank reconciliation statement is a valuable internal tool that can affect tax and financial reporting and detect errors and intentional fraud. A bank reconciliation statement is important because it helps identify any discrepancies between the bank statement balance and the company’s book balance. It is a method of matching a company’s financial records with the bank statement to ensure that all transactions are accurate and accounted for in the financial report. This process is crucial for maintaining the accuracy of financial statements and ensuring that the company’s financial records are up-to-date.

So it makes sense to record these items in the cash book first in order to determine the adjusted balance of the cash book. Once the adjusted balance of the cash book is worked out, then the bank reconciliation statement can be prepared. Once you have identified all the differences between the two statements, identify the source of the discrepancy. Common sources include deposits in transit that have not yet been deposited in your bank account, as well as bank fees that have been withdrawn by your bank but may have been missed in your company records. By comparing the two statements, Greg sees that there are $11,500 in checks for four orders of lawnmowers purchased near the end of the month.